As a consequence, indexing the minimum wage to median hourly wages would lead to slightly larger effects on employment, wages, and family income.ĭirectly affected workers. Historically, median hourly wages have grown faster than the CPI, and CBO expects that pattern to continue over the next 10 years (starting in 2023). Users of this interactive tool can index minimum wages to the consumer price index (CPI, a common measure of the cost of living) or index minimum wages to median hourly wages. Past increases in the federal minimum wage have not been indexed, so the value of those increases has been eroded by inflation. Users of this interactive tool can leave the minimum wage unchanged after the end of the phase-in period or change it in one of two ways.įurther adjustments to the minimum wage: Indexing the minimum wage means automatically adjusting it after it reaches the target amount. Year in which the specified increase would be fully implemented: Like previous increases in the minimum wage, the options presented here would take a number of years to be fully implemented. In each case, the percentage difference between the federal minimum wage and the subminimum wage would be maintained after the implementation period ends. Users of this interactive tool can leave the subminimum wage unchanged, increase it by varying amounts each year until it reaches 50 percent of the federal minimum wage, or increase it by varying amounts each year until it matches the federal minimum wage.įor the default policy based on the Raise the Wage Act of 2021, the subminimum wage would be $4.95 in 2023, $6.95 in 2024, $8.95 in 2025, $10.95 in 2026, $12.95 in 2027, $14.95 in 2028, and equal to the federal minimum wage thereafter.

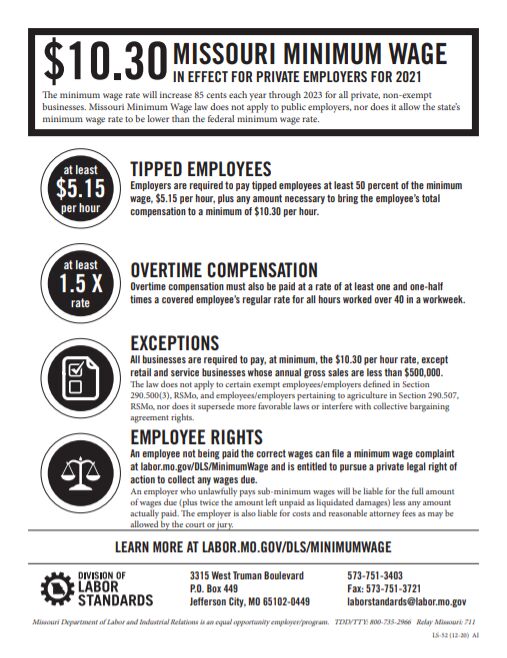

Subminimum wage for tipped workers: Cash earnings (excluding tips) must exceed $2.13 per hour under current law, and total hourly earnings (including tips) must equal the federal minimum wage. For the default policy based on the Raise the Wage Act of 2021, the minimum wage would be $9.50 in 2023, $11.00 in 2024, $12.50 in 2025, $14.00 in 2026, and $15.00 in 2027 and would be indexed to changes in median wages thereafter.

MINIMUM WAGE INCREASE 2021 FULL

The federal minimum wage would rise by varying amounts each year until it reached the target amount in the year specified for full implementation. In general, increasing the federal minimum wage would raise the earnings and family income of most low-wage workers, lifting some families out of poverty-but it would cause other low-wage workers to become jobless, and their family income would fall.įederal minimum wage: Options for the target amount for the hourly minimum wage range from $10 to $15 (in $1 increments). Users can also create custom policy options to examine how different approaches to changing the minimum wage would affect people’s earnings, employment, family income, and poverty. After reaching their targets, both minimums are indexed to changes in median hourly wages. The subminimum wage for tipped workers reaches parity with the regular minimum wage two years later. 53), which CBO analyzed in The Budgetary Effects of the Raise the Wage Act of 2021.įor the default policy shown here, the standard minimum wage reaches $15 per hour in 2027, four years after the first incremental increase. The default option in this interactive tool is based on the Raise the Wage Act of 2021 (S. This interactive tool-developed and updated by the Congressional Budget Office-allows users to explore the effects of policies that would increase the federal minimum wage, which is $7.25 per hour and has not changed since 2009. Refine Results By How Increasing the Federal Minimum Wage Could Affect Employment and Family Income

0 kommentar(er)

0 kommentar(er)